Wacc calculator online

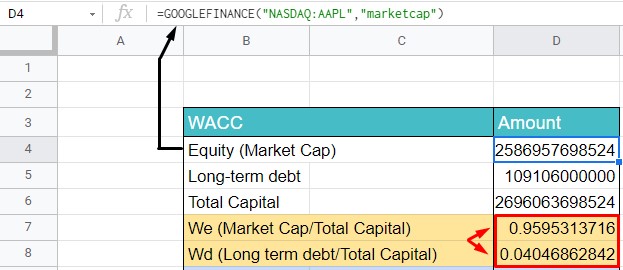

E Market value of the firms equity D Market value of the firms. V The sum between.

Wacc For A Private Company Formula And Calculator

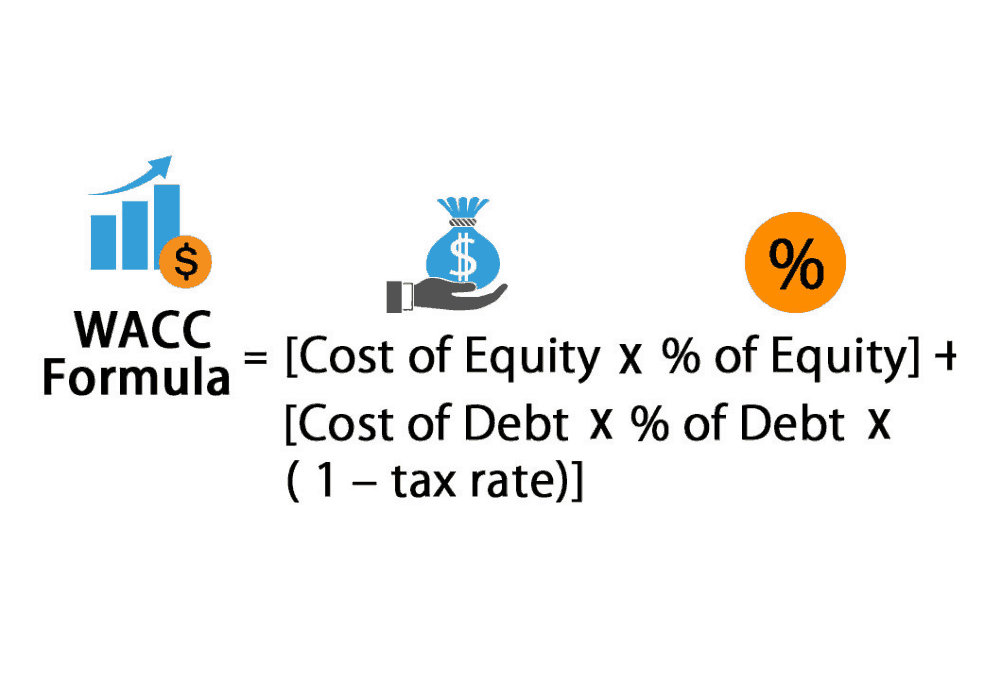

Mycalcu uses the following formula to find WACC.

. WACC is a very important metric and used in investment decisions. The algorithm behind this WACC calculator applies the formula explained here. It is very often called the hurdle rate.

Capital Asset Pricing Model CAPM WACC Weighted Average Cost of Capital The weighted average cost of capital WACC is the rate that a company is expected to pay on average to all. HOW MYCALCU FINDS WACC. It makes the life of a Businessman easy.

HOW MYCALCU FINDS WACC. Fortunately the WACC calculator at Thats WACC does all the hard work for you. Corporate Tax Rate Ctr as a percent.

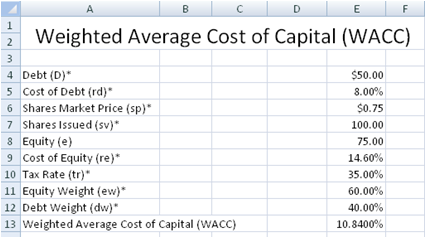

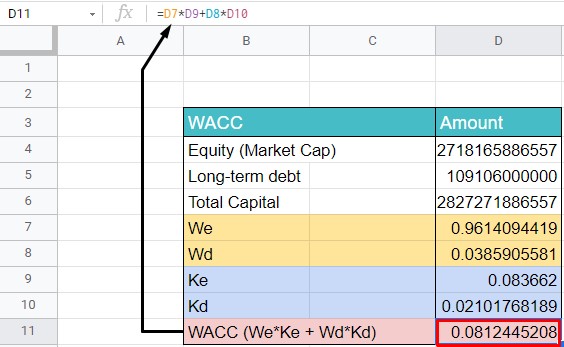

Re cost of equity. WACC EV Re DV Rd 1 - Ctr Where. WACC EV Re DV Rd 1-Tc Where.

The Fairness Finance simplified Wacc calculator can be used to estimate the cost of capital applicable for discounting operating cash flow. The WACC formula is. Mycalcu uses the following formula to find WACC.

Calculating WACC is straight forward when you know what the components in it. E market value of the firms equity market cap D market value of the firms debt V total value. It is very often called the hurdle rate.

Weighted Average Cost of Capital is a financial metric used to measure the cost of capital to a company. WACC EV R e DV R d 1-T c V E D Where WACC Weighted Average Cost of Capital E Market value of the firms equity D Market value of the firms debt V Firm. Below we have outlined the simple steps to follow for the purpose of the weighted average cost of capital calculation in this digital gizmo of ours.

WACC is a very important metric and used in investment decisions. WACC EV Re DV Rd 1 - Tc where. WACC equity weightage x equity cost debt weightage x debt cost x 1- tax rate However you dont have.

WACC EV x Re DV x Rd x 1 T Where. WACC equity weightage x equity cost debt weightage x debt cost x 1- tax rate However you dont have. Calculating WACC is straight forward when you know what the components in it.

D market value of the. Example if the cost of equity capital. E market value of the firms equity.

Rd cost of debt. It is used in financial modelling as the discount rate to calculate the net present. The following is the WACC calculation formula.

Enter a stock ticker symbol for any public company and Thats WACC pulls back 3 years of Income. Calculations and knowing the exact value of WACC Calculator will save lots of precious time. This calculator will calculate using the appropriate formula for weighted Average Cost of Capital WACC Input your Cost of Equity Capital.

The mathematical WACC equation of the formula for WACC is as follows. How to use the tool.

Best Excel Tutorial How To Calculate Wacc In Excel

Best Excel Tutorial How To Calculate Wacc In Excel

+Excel+Formula.JPG)

Wacc Calculator And Step By Step Guide Discoverci

How To Calculate The Wacc Using Excel Step By Step Guide Iifpia

Wacc Formula Definition And Uses Guide To Cost Of Capital

Wacc Formula Cost Of Capital Plan Projections Cost Of Capital Finance Debt Accounting Basics

Free Weighted Average Cost Of Capital Wacc Spreadsheet

Wacc Calculator Calculate Weighted Average Cost Of Capital

How To Calculate Wacc In Excel Step By Step Guide Free Excel Calculators

Best Excel Tutorial How To Calculate Wacc In Excel

How To Calculate The Wacc Using Excel Step By Step Guide Iifpia

Wacc Calculator Find Weighted Average Cost Of Capital

Wacc Formula Calculator Example With Excel Template Excel Templates Formula Excel

Step By Step Tutorial For Calculating Weighted Average Cost Of Capital Wacc Stockbros Research

Wacc Calculator Formula Weighted Average Cost Of Capital

Wacc Finance Archives Free Excel Calculators

Weighted Average Cost Of Capital Wacc Formula And Calculation